PayTeen

PayTeen is a money management platform that develops financial responsibility among 13 to 18 year olds. This project was my undergraduate thesis project.

To create a platform that guides and assists a user in making financial decisions with respect to short-term and long-term savings and investment goals, in an Indian context

DESIGN GOAL

TEAM MEMBERS

Solo project

CASE STUDY TIMELINE

Feb - May 2020 ( 4 Months )

MY DESIGN PROCESS

Prototype

Research

Insights

Solution

Research

INITIAL ROUND OF RESEARCH

SECONDARY -

Initially, a series of money management applications were inspected.

The goal when conducting research was to analyze how existing Money Management apps provide guidance with respect to short-term and long-term investments and savings

PRIMARY -

In addition to the analysis of money budgeting applications, people of different ages, ranging from 18 to 65 years, were interviewed about their money management and investing habits.

Insights

WHY DON'T PEOPLE BEGIN INVESTING EARLY?

-

Most young adults do not know how to manage their finances properly. This lack of knowledge can lead to them getting caught in an infinite debt cycle.

-

This problem of having limited knowledge of finance management is primarily stemmed from them not having learned how to manage small amounts of money before they began working and earning.

PRIMARY INSIGHTS

Providing a safe environment for Young Adults (13 - 21 years) to learn how to manage money, can lead to them efficiently managing their finances in the future.

REFINING THE GOAL

Based on the insights gained, the goal of the project was refined:

How can we create a platform that allows a teenager to understand and explore financial independence before they begin working and earning?

Keeping the refined goal in mind, the various factors that influence a teenager's spending were mapped out :

THE INTERVENTION

Solution

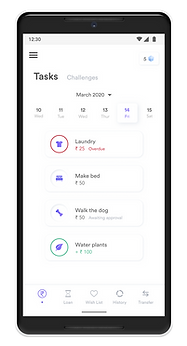

PayTeen is a mobile application that incorporates money management into the daily activities of a teenager, thus allowing them to be more financially responsible in the future.

The app was designed such that parents also had a platform, through which they can monitor their child's spending patterns.

PRODUCT FEATURES

1. EARN MONEY

-

Teens earn money by completing tasks and challenges

-

Parents can set up tasks, and approve completed tasks

3. SET-UP LOANS

-

Teens can borrow money from parents and return in installments

-

Parents can view their child’s loan repayment progress

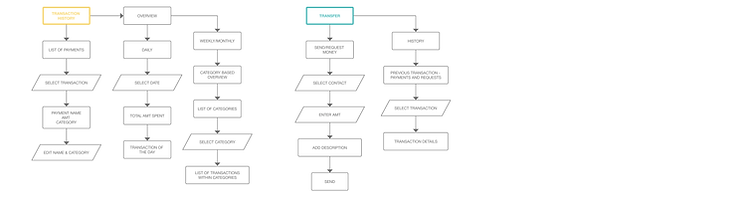

5. TRANSFER

-

Teens can transfer and request money among family, as well as within their own account

-

Parents have the option to transfer or request money from family

2. CREATE A WISHLIST

-

Teens have the option to create and save money towards ‘Wishes’

4. HISTORY

-

Teens can view their monthly/daily expenses

-

Parents have access to their child’s monthly expense history

6. PROFILE

-

Parents can access each child’s progress and expenses with ease

TEEN PLATFORM

USER FLOWS

Prototype

PARENT PLATFORM

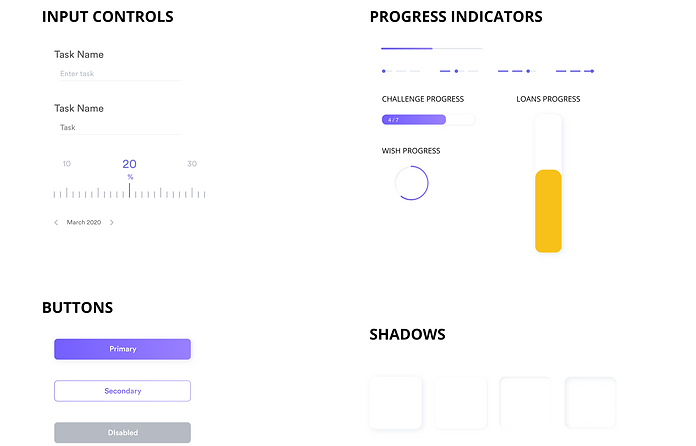

DESIGN GUIDE